Value proposition

A merchant-embedded saving-based purchase experience (Save Now, Buy Later). (Techstars 2017) (Google LaunchPad 2018)

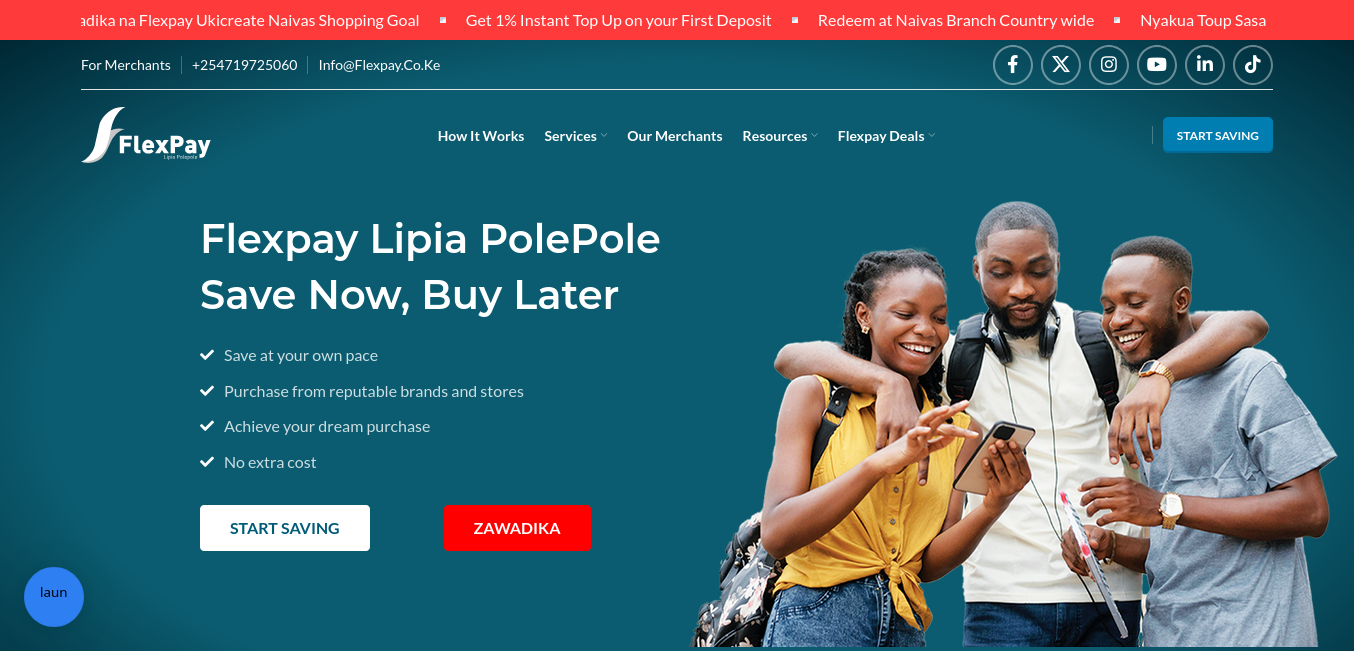

Flexpay is a merchant-embedded digital save-to-buy experience that rewards customers for saving up for large and small purchases they need.

We collaborate with retailers, brands, marketplaces, and banks to reward customers for saving up for the things they want, closing the affordability gap debt-free, increasing customer retention, and growing sales for the merchants.

Low disposable incomes limit a vast majority of Africans from buying or accessing product and services they want. Additionally, consumers are being pushed towards the booming ‘Buy Now, Pay Later’ credit driven models in the consumption ecosystem, which is predatory and leads to impulse buying and debt. There has never been anything embedded in the retail experience that incentivizes people to save up for purchases as a way of closing the affordability gap.

FlexPay is backed by Techstars, Google LaunchPad and Google Black Founder's Fund.

Fintech, Retail, Mobile payments, and piecemeal

Flexpay Lipia Polepole - Flexpay

https://www.flexpay.co.ke - Website is disabled or domain is for sale