Value proposition

Automating climate risk management for insurers and asset managers. Transition, physical, and liability risks.

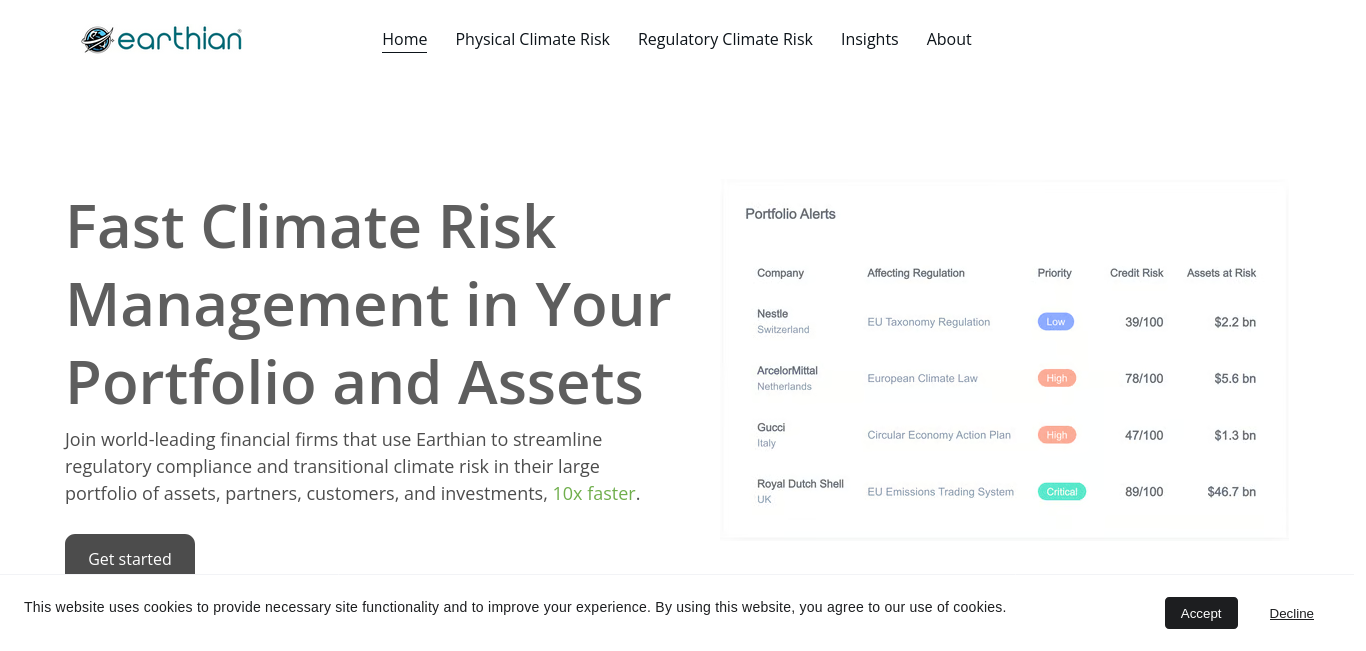

Stemming from research at Harvard University, Earthian AI offers financial institutes the AI ecosystem for climate regulatory risk identification and mitigation in their portfolio of companies and assets. Our award-winning solution, Earthian Hub, enables asset managers, reinsurers, and banks to see the true environmental risk in their portfolio and get accelerated growth in leveraging the opportunities of a $10 trillion sustainable transition. We provide high-resolution regional financial-focused climate regulation data next to detailed company data driven by our sustainability engine with the capacity to process over 10 million data points from news updates to regulations, company filings, and satellite imaging. They are able to improve the accuracy of ESG due diligence and climate underwriting by 200% and reduce the workload by 85% with our instant climate and sustainability report generation and risk analytics using our LLM interface, visual platform and APIs.

Climate Risk Management in Financial Portfolios | Earthian AI

Earthian AI provides innovative solutions for climate regulatory risk identification and mitigation, empowering financial institutions to navigate environmental challenges and seize sustainable growth opportunities in their portfolios with advanced data analytics and insights.

https://earthianai.com/