Value proposition

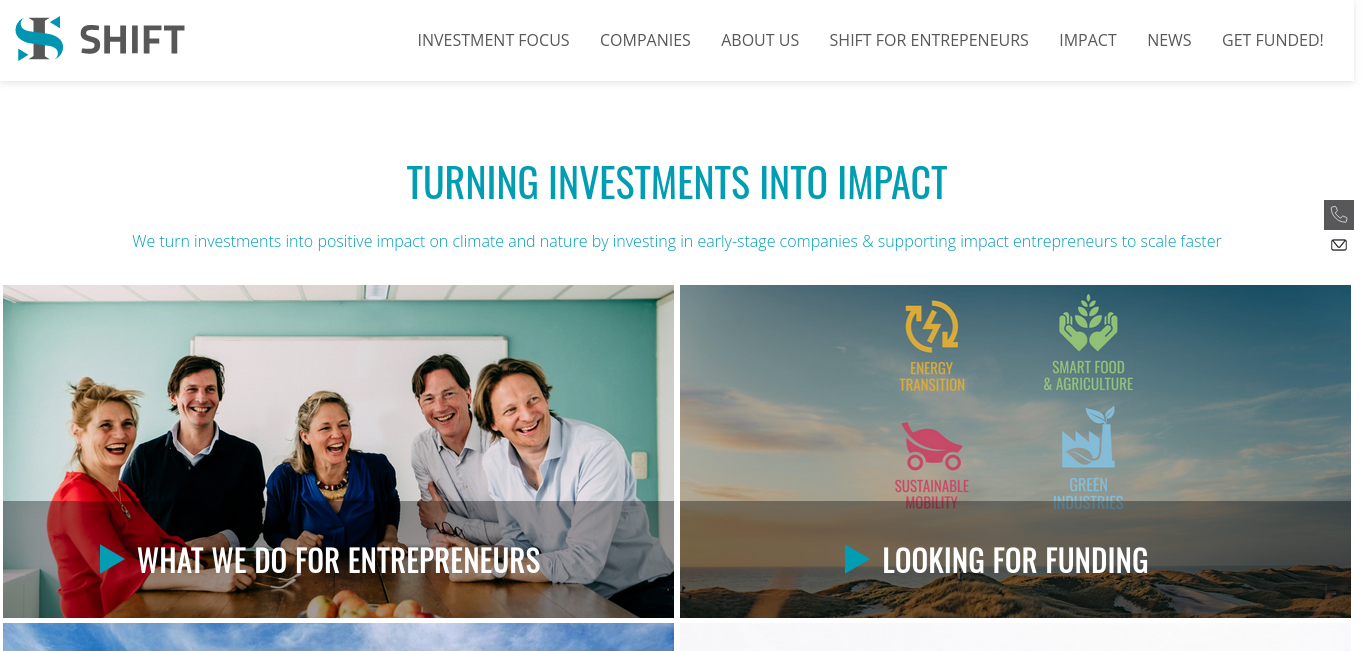

Turning investments into impact

SHIFT Invest, founded in 2009, is an impact venture capital fund. We turn investments into positive impact on climate and nature by investing in early-stage companies and supporting impact entrepreneurs to scale faster.

Based on our fund-level impact mission we strive to bring back the balance between nature and society by fighting climate change, loss of biodiversity and depletion of the resources of the planet. We do so by supporting and investing in innovative start ups and scale ups contributing to this mission in the themes: food & agriculture, green industries, energy and mobility.

Together with our partners, we offer entrepreneurs an extensive network and insights into various sectors.

Our involvement in the start ups and scale ups we invest in is above all about the support we can give to the people who run them. This support is based on our core qualities analytic, reliable, professional and our broad expertise.

We are a diverse and experienced team committed to accelerate innovation by supporting the creation and acceleration of great companies. We work according to our values, professional, ambitious, entrepreneurial and fun.

Venture capital, Start ups, Innovation, and Impact Investing

Home - SHIFT Invest

Home - SHIFT Invest

https://shiftinvest.com/

| Entity | Type | Tweets | Articles | |

|---|---|---|---|---|

| LUMO Labs Venture Capital and Private Equity Principals | Other 30 Jun 2024 | | |

| DSM Chemical Manufacturing | Other 5 Aug 2024 | | |

| FononTech it services | Other 31 Mar 2024 | | |

| Roboat transporttech | Other 7 Jul 2024 | | |

| NoPalm Ingredients greentech, foodtech | Other 30 Sep 2022 | | |

| Steward Redqueen constructiontech, consulting, Business Consulting and Services | Other 31 May 2024 | | |

| Maxem Energy Solutions energytech | Other 30 Sep 2024 | | |

| Enel Green Power Renewable Energy Semiconductor Manufacturing | Other 31 Mar 2024 | | |

| Grant Thornton Netherlands fintech, Accounting | Other 31 Dec 2023 | | |

| Gilde Healthcare Financial Services | Other 31 Dec 2023 | | |